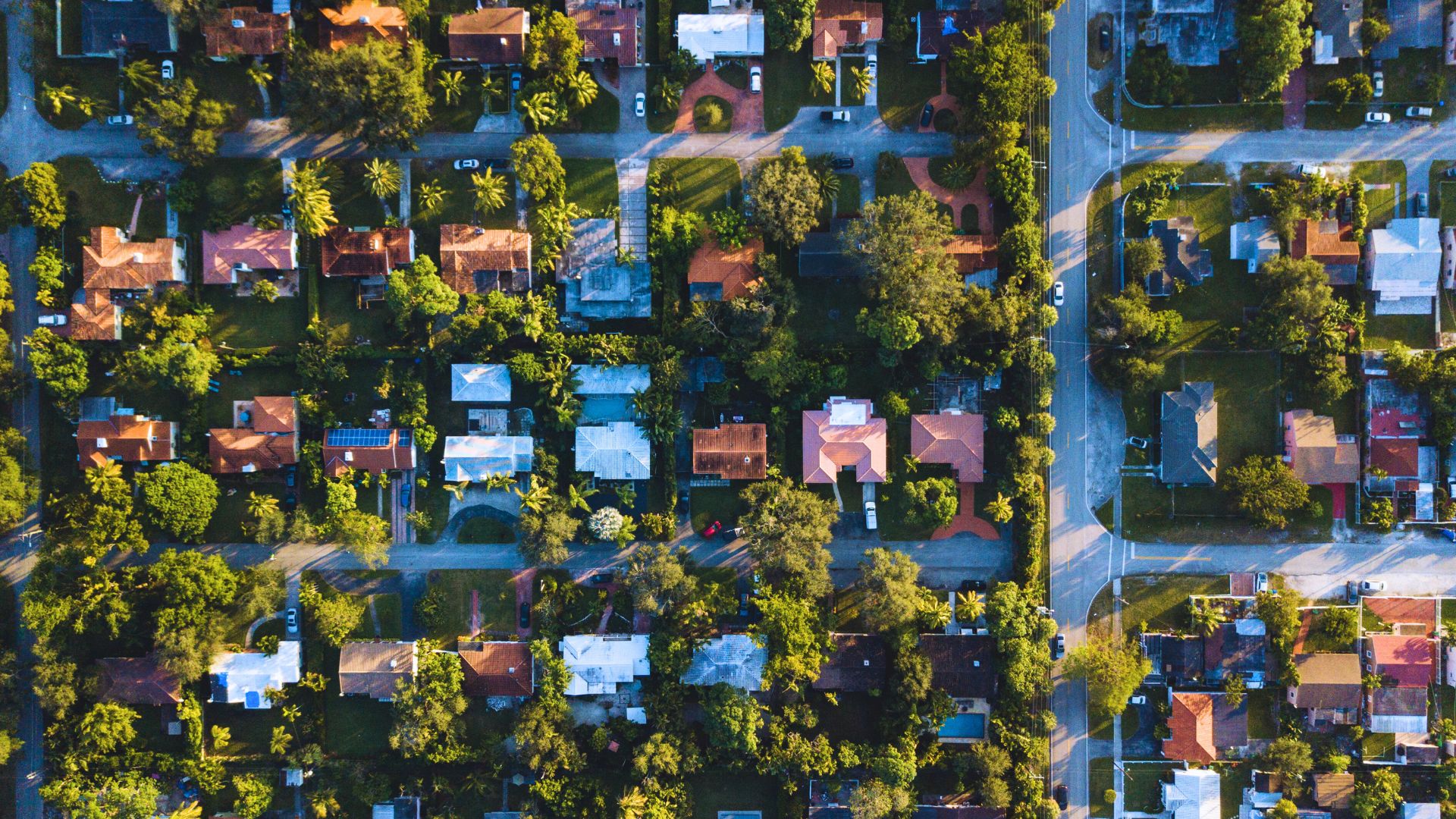

There comes a time when that big house, the one filled with memories, starts feeling a little too big. Downsizing in retirement isn’t just about moving to a smaller space; it’s about stepping into a lifestyle that’s lighter, freer, and better suited to the way you want to live now. It’s about simplifying daily life, cutting down on maintenance headaches, and making room for what matters most. That said, today’s housing market isn’t quite what it used to be. Mortgage rates are climbing, and smaller homes don’t always come with smaller price tags. Some might even wonder why downsizing in retirement might be a terrible idea, but with the right planning, the move can still bring big benefits.

Downsizing for Retirement: Is It the Right Move for You?

More Money, Less Worry

One of the biggest perks of downsizing for retirement? Financial freedom. A smaller home means lower monthly bills. Think taxes, utilities, and maintenance, which add up to more money in your pocket. Selling a larger home often frees up equity that can be tucked away for future needs, invested for passive income, or even used for that long-awaited dream vacation. Before you make any moves, take the time to learn how to downsize your home for retirement. Sit down and crunch the numbers, comparing your current costs with what you’d spend in a smaller place, factoring in real estate fees and moving expenses.

Say Goodbye to Endless Chores

Less house means less work. A smaller space is easier to clean, maintain, and manage, giving you more time to focus on hobbies, travel, or simply enjoy a slower pace of life. Retirement downsizing also forces you to declutter, helping you keep only the things that truly bring value to your life. Start the decluttering process early by tackling one room at a time and using the “keep, donate, sell” method to make decisions easier.

A Debt-Free Retirement

Selling your larger home can help you knock out lingering debts, such as a mortgage or personal loans. Downsizing after retirement and becoming debt-free means less stress and more flexibility to enjoy life without financial burdens hanging over your head. Work with a financial advisor to explore options for using your home sale proceeds wisely, whether it’s investing, paying off debts, or creating a steady income stream.

Freedom to Move Where You Want

Downsizing your home for retirement gives you the chance to relocate. That can mean moving closer to family, settling in a warmer climate, or choosing a town with a lower cost of living. Many retirees opt for areas with better healthcare access, walkable communities, or places that align with their new lifestyle goals. Consider renting in your desired location for a year before buying a home to get a feel for the area and make sure it’s the right fit.

A Home That Grows With You

As we get older, climbing stairs and maintaining a large property can become challenging. Downsizing in retirement to a single-level home or a property with accessibility features can make daily life easier and safer, reducing the risk of falls and accidents. Planning ahead now means you’ll be better prepared for future health needs. Look for homes with wider doorways, step-free entrances, and the potential for mobility-friendly upgrades.

A Fresh Start, Emotionally Speaking

Sure, saying goodbye to a family home can be tough, but downsizing for retirement can also be an exciting opportunity for a fresh start. A smaller, cozier space in a new neighborhood can bring new social opportunities and a renewed sense of adventure. Letting go of extra “stuff” can also be freeing in ways you might not expect. Take your time and involve your loved ones in the process. Reflect on the memories but focus on the exciting possibilities ahead.

A Lighter Environmental Footprint

Retirement downsizing isn’t just good for your wallet; it’s also great for the planet. Smaller homes use less energy, which means lower utility bills and a reduced environmental impact. Moving to a more energy-efficient home with smart appliances and better insulation can make a big difference. When house hunting, look for properties with features like solar panels, smart thermostats, and water-saving fixtures.

More Freedom to Explore

Imagine packing up and taking off on spontaneous weekend getaways or long-term adventures without worrying about yard work or home maintenance. Downsizing after retirement makes it easier to enjoy a lock-and-leave lifestyle, perfect for retirees who love to travel and explore new places. Consider low-maintenance options like condos or gated communities where upkeep is handled for you so you can focus on enjoying life.

Why Downsizing in Retirement Can Be a Terrible Idea

Downsizing sounds great in theory—less space, fewer expenses, and a fresh start. But in reality, it’s not always the best choice. With rising home prices and moving costs, a smaller place doesn’t always mean smaller bills. Unexpected expenses like HOA fees, property taxes, and renovations can quickly eat into any savings you were hoping to gain. Then there’s the emotional side. Leaving behind a home full of memories can be tough, and adjusting to a new, smaller space might not feel as cozy as you’d hoped. Plus, less space could mean fewer visits from family or not enough room for hobbies you enjoy. Before taking the leap, think about what you really need and whether a smaller home will truly fit your retirement lifestyle.

Ready to downsize for retirement? Let a REMAX agent help you find a home that’s just the right fit—less maintenance, more freedom, and a lifestyle that works for you.