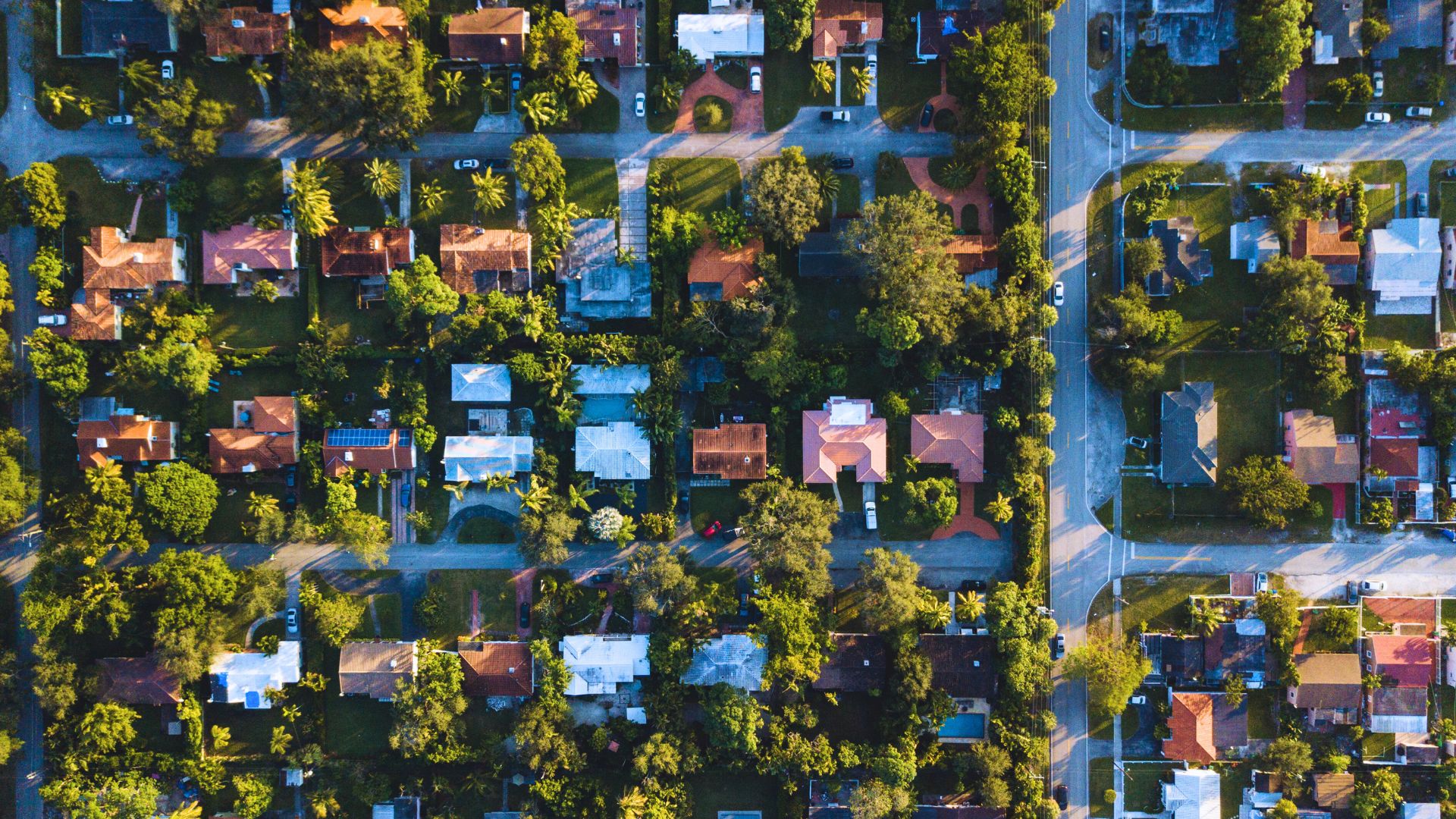

It goes without saying that buying a home is not cheap. While some homeowners can manage their housing costs, others are not so fortunate and are considered house poor. According to a Lending Tree study, nearly 20 million American homeowners across the U.S. are house-poor. If housing costs take up a big chunk of your income, it can leave you struggling to keep up with daily expenses and make it tough to save for the future.

What Does It Mean to Be House Poor?

So, what is house poor? Being house-poor refers to a situation where a homeowner spends such a large portion of their income on housing-related costs like mortgage payments, property taxes, and homeowners’ insurance that they struggle to afford other necessary expenses. While homeownership helps build equity over time, being financially stretched can make it difficult to cover everyday costs like groceries, utilities, and transportation or contribute to savings and investments.

Financial experts recommend following the 28/36 rule, which means your total housing costs should not exceed 28% of your gross monthly income, while your total debt payments, including car loans, credit cards, and student loans, should stay under 36%. Going beyond these limits increases the risk of becoming house poor, where housing expenses consume too much of your income.

The Ongoing Costs of Homeownership

To avoid becoming house poor, you must know all the expenses that come with owning a home. Many first-time buyers focus on the mortgage but don’t fully understand what it means to be house-poor. It often happens when hidden or overlooked costs make homeownership more expensive than expected.

Property Taxes

Property taxes are a recurring expense that depends on local tax rates and home value. These costs vary widely across the country, with some states imposing significantly higher taxes than others. For example, New Jersey has some of the highest property tax rates, while Hawaii offers some of the lowest despite its high real estate prices. Since property values often appreciate over time, homeowners should also prepare for potential tax increases, which could raise their overall cost of ownership.

Homeowners Insurance

Homeowners insurance protects against damages, theft, and liability, ensuring financial security in case of unexpected events. The cost of coverage varies based on the home’s location, size, and risk factors, such as extreme weather conditions. Florida, for instance, has some of the highest insurance premiums due to the frequent risk of hurricanes. Homeowners should carefully compare policies to find the right balance of affordability and protection, so they have enough coverage to rebuild or repair their home if disaster strikes.

Private Mortgage Insurance (PMI)

For homeowners who make a down payment of less than 20%, private mortgage insurance (PMI) is often required by lenders. This additional expense is meant to protect the lender in case of default. PMI typically costs between 0.5% and 2% of the loan amount per year, but it can be eliminated once the homeowner reaches at least 20% equity in their property. While PMI adds to the cost of homeownership, some buyers accept it as a trade-off for getting into a home with a smaller down payment.

Home Maintenance & Repairs

Keeping a home in good condition requires ongoing maintenance and occasional repairs. Experts recommend setting aside 1-2% of the home’s value annually to cover costs like roofing, plumbing, electrical work, and HVAC servicing. Neglecting regular upkeep can lead to more expensive repairs down the line, making proactive maintenance a smart financial decision.

Utilities

Monthly utility bills can add up quickly and vary based on the size of the home, energy efficiency, and local climate. Essential utilities include electricity, water, gas, trash removal, and internet service. Homeowners in colder regions like Minnesota often pay higher heating costs in the winter, while those in hotter states like Texas spend more on air conditioning. Investing in energy-efficient appliances and insulation can help reduce utility expenses over time.

HOA Fees (If Applicable)

Homeowners Association (HOA) fees are mandatory for those living in condos or planned communities. These fees cover services such as landscaping, security, and shared amenities like pools and fitness centers. The cost of HOA fees varies depending on the community and its offerings. While some homeowners appreciate the benefits of an HOA, others may find the additional expense restrictive, especially if the fees increase over time.

What to Do If You’re House Poor

Now that you know what is house poor, some of you may realize that your housing costs are stretching your budget too thin. But don’t panic. There are steps you can take to regain financial stability. Making adjustments to your expenses or exploring new financial options can help you stay afloat and avoid long-term financial stress.

Refinance or Downsize

If your mortgage payments are too high to manage comfortably, refinancing or downsizing may be the best solution. Refinancing can lower your monthly payments by securing a better interest rate or extending your loan term. If refinancing isn’t an option, consider downsizing to a smaller, more affordable home that better fits your budget. While this may feel like a big change, it can provide long-term financial relief and prevent you from falling deeper into debt.

Trim Discretionary Spending

Cutting back on non-essential expenses can free up extra money to cover your housing costs. Take a close look at your budget and identify areas where you can reduce spending, such as dining out, entertainment, and travel. Simple changes like cooking at home more often, canceling unused subscriptions, or delaying major purchases can make a significant difference. These adjustments don’t have to feel restrictive, small sacrifices now can help you regain financial stability.

Find Additional Income Sources

If cutting expenses isn’t enough, increasing your income can provide the extra cash you need to cover housing costs. Consider taking on a side gig, freelancing, or part-time work that fits into your schedule. Renting out a spare room or listing your space on Airbnb can also bring in extra income without requiring a long-term commitment. Even small income boosts can help bridge financial gaps and provide more breathing room in your budget.

Buying a home is a big step and knowing “what does house poor mean” can help you stay financially secure. REMAX agents are here to help you find a home that fits your budget so you don’t end up house-poor. A REMAX agent can make sure your dream home is one you can truly afford—connect with a REMAX agent today!