Second Mortgage vs Refinance

Which Option Makes More Sense for Homeowners

Many homeowners eventually need to access the value built up in their homes, whether for renovations, debt consolidation, or other major expenses. The question is how to do it. Two popular paths are taking a second mortgage or doing a refinance. Both unlock home equity, but they work in very different ways, and one may cost you far more over time.

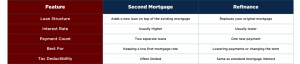

Key Differences Between a Second Mortgage and Refinance

What Is a Second Mortgage

A second mortgage lets you borrow against your home’s equity without disturbing your existing loan. You’ll make two payments: one for your original mortgage and one for the new loan. [Read more about how second mortgages work here.]

When a Second Mortgage Makes More Sense

- You want cash without touching a great first-mortgage rate. A second mortgage can be the cleaner play.

- You locked a low rate on your first mortgage and want to keep it

- You need a set amount of cash for projects or debt consolidation

- You want fixed payments and a clear payoff schedule with a home equity loan

- You plan to repay faster than a full new 30-year loan

- Closing costs on a full refinance make the math ugly

Quick gut check

If your current rate is lower than today’s market by a full percentage point or more, a second mortgage often wins on total cost.

When Refinancing Is the Better Option

Sometimes simpler is smarter. One loan. One payment.

- Market rates are meaningfully lower than your current rate

- You want to change loan terms, such as 30 to 15 years or ARM to fixed

- You plan to stay in the home long enough to break even on refi costs

- You want to roll everything into one payment and reset amortization

- Your credit profile has improved and now qualifies for better pricing

Break-even tip

Divide total refi costs by your monthly savings. If you will live in the home longer than that number of months, the refi pays for itself.

Qualifying and Cost Differences That Matter

- Equity

Most lenders cap the combined loan-to-value at 80 percent. Second mortgages may allow a bit less headroom than a prime refi. - Credit and income

Mid-600s and up helps for either option. Lower scores can push second mortgage rates higher than a prime refi. - Fees and speed

Refis usually carry higher total closing costs and longer timelines. Second mortgages often close faster with lower upfront fees. - Payment structure

A second mortgage means two payments. Refi means one new payment that restarts amortization.

Risk of Each Option

Know the trade-offs before you sign anything.

Second mortgage risks

- Higher rate than your first mortgage in most cases

- Two monthly payments to manage

- Fees and a lien in second position

- Tap too much equity, and you reduce your safety cushion

Refinance risks

- You can lose a great old rate

- Closing costs can take years to recover

- Restarting the clock can increase lifetime interest

- Cash-out temptations can turn into new debt fast

Long-Term Impact on Home Equity and Future Borrowing

Choosing between a second mortgage and a refinance affects more than your current cash flow. It also shapes your long-term financial flexibility.

When you refinance, your new mortgage resets the clock on your equity growth. Each payment builds equity slowly again, which can delay full ownership. A second mortgage, by contrast, keeps your original amortization schedule intact, so you keep gaining equity on the first loan even while repaying the second.

Your decision also influences future borrowing. A refinance may simplify future credit applications since it leaves you with one loan, but it reduces your immediate borrowing power. A second mortgage preserves your first loan but can raise your debt-to-income ratio, making it harder to qualify for other credit.

If you plan to move, sell, or apply for another major loan in the next few years, factor these long-term impacts into your math. The cheapest option today is not always the smartest one five years down the road.

Second Mortgage vs Refinance

Choose the tool that fits the job. If your current rate is a keeper and you need a defined chunk of cash, a second mortgage is usually the sharper knife. If mortgage rates have dropped and you want one clean payment with new terms, refinancing can lower the total cost. Run the numbers both ways, include fees, and use a break-even test. The right choice is the one that saves real money without wrecking your future budget.