When you’re getting ready to buy a house, one of the most important questions is how much you can afford on your current salary. The income needed for a 500K mortgage depends on a number of factors that combine to create an overall financial picture. Lenders use these elements to get a clear idea of how well you can handle a mortgage of this size.

This guide walks you through the components of credit-worthiness and how you can improve your chances of getting a 500K home loan.

How Lenders Decide on Affordability

If you’re applying for a mortgage on a 500K house, your lender will want to know the following:

Down Payment Amount

Down payments are typically 15% to 20% of the house price, but a larger down payment is always better and can help you qualify for a more expensive home. Saving for a down payment can be difficult, but there are loan programs that can help, including programs that don’t require a down payment at all.

Credit Score

For a conventional mortgage, aim for a minimum credit score of 620, 740 if you want to get the best rates and lowest private mortgage insurance costs. Some loan programs, such as FHA loans, allow for credit scores as low as 580.

Other Debt Payments

Your other debts determine how much you have left over for your mortgage payments. The salary to afford a 500K house must include the mortgage payments and your other debt servicing obligations, including loans and credit cards.

Property Taxes

Regular payments like property taxes and HOA fees reduce the amount you can spend monthly on your mortgage. You won’t know these figures while you’re shopping, so you’ll need to use estimates.

Interest Rate

A lower interest rate means one of two things: either your mortgage payments will be lower, or you’ll be able to buy a more expensive house with the same salary. Even with a 1% interest rate drop, the annual salary to afford a $500K house is lower. In general, mortgage applicants get a better interest rate if they have a lower credit score.

How Much Should You Make to Buy a $500K House?

The baseline calculation below will give you a starting point. From there, you can see where to make adjustments so you can get into your dream home.

This calculation is based on these assumptions:

- Purchase price: $500,000

- Down payment: 20% ($100,000)

- Loan amount: $400,000 (conventional, 30-year fixed rate @ 7%)

- Principal and interest: $2,661/mo

- Taxes and insurance: $800/mo

- HOA fees: $200/mo

- Estimated monthly housing costs: $3,661

With your estimated monthly housing costs in hand, you can figure out if lenders are likely to give you a $500K house loan. Mortgage lenders use the 28/36 rule as a rough estimate of how much house you can afford on a given salary. Here’s how that rule applies:

The 28% Test

The 28% test means that your total housing costs shouldn’t exceed 28% of your gross monthly income. Total housing costs include your mortgage payments, property taxes, insurance, and HOA fees if applicable.

To figure out the income needed for a 500K mortgage under the 28% test, you have to work backwards. This can be confusing, so try working forward first to understand it better. Working forward from $157,000 annual salary, the 28% test recommends spending no more than $3,663 on housing costs monthly ($157,000 X 0.28)/12

Working backwards from the loan amount, you would need a monthly salary of approximately $13,075 ($3,661 in monthly housing costs ÷ 0.28) to qualify for a $500K home loan. Annually, that’s $157,000.

The 36% Test

The 36% test is also called the back-end ratio. This ratio includes housing costs plus recurring monthly obligations such as car payments, credit cards, or student loans. The rule recommends that you spend no more than 36% of your salary on these combined costs.

Let’s say your debt payments are $750 per month. Your total monthly obligations would then be $4,411 ($3,661 + 750). Working backwards, you would need a gross monthly income of $12,250, or $147,000 annually, for a 500K home loan.

Lenders commonly use the 28% test as a general indication of how much house you can afford, but the 36% test for actual loan approvals. Used together, these two tests help both lenders and buyers understand what’s affordable for housing alone, and what’s sustainable once all other debt payments are included.

How Much I s a Down Payment for a 500k House

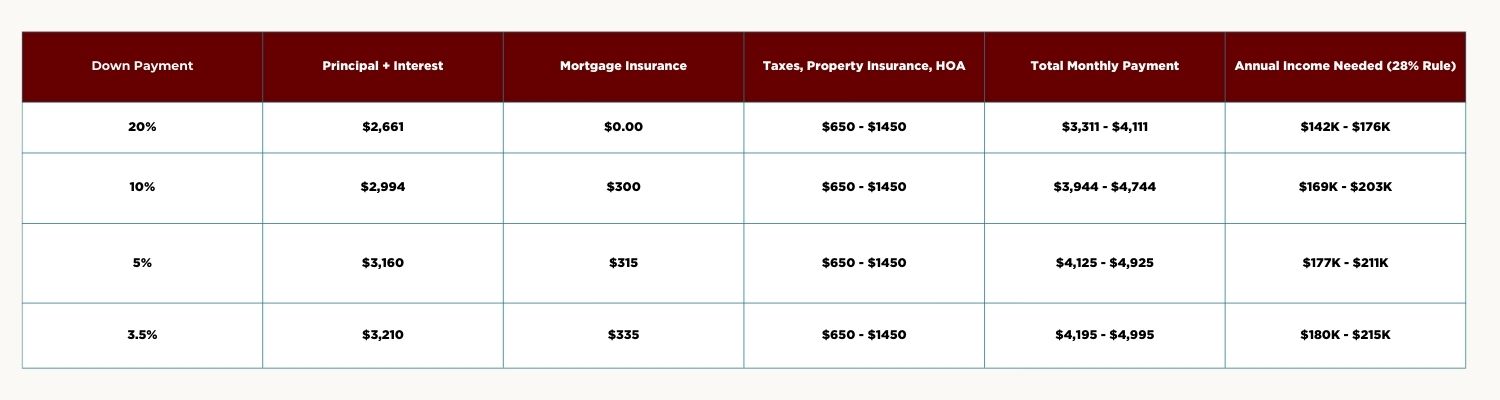

On average, American homebuyers put between 10% and 20% down on a house. However, a larger down payment means that you’re income doesn’t have to be as high to qualify for the same size mortgage. Here’s how it works for a mortgage on a 500K house:

As you can see, a larger down payment makes a considerable difference because you’re not borrowing as much. That makes your principal and interest payments lower and can also eliminate your private mortgage insurance.

Ways to Improve Your Chances of Getting a 500K Home Loan

If you want a 500K home loan but the numbers aren’t working out, you’ll need to make adjustments. Here are some key strategies:

Reduce Your Outstanding Debt

If your housing costs are $3,500 a month and you have no other outstanding debt, you’ll need $117,000 a year for a 500K home loan under the 36% rule. However, if you have $1,500 per month in additional debts, the Income needed for a 500K mortgage is $167,000 a year.

Improve Your Credit Score

Stay up to date with your credit card and loan payments. Also, avoid any new credit. A higher credit score will qualify you for a lower interest rate.

Make a Larger Down Payment

As illustrated by the chart above, a larger down payment means that you can get a 500K home loan with a lower salary.

Affording a $500k House

How much should you make to buy a 500K house? The answer is not as straightforward as it might seem. However, a mortgage lender or financial planner can help you understand your financial picture and put you on the path to homeownership, and an experienced real estate agent can show you options that fall in lower price ranges. Getting onto the property ladder on a lower rung can make it easier to qualify for a 500K home loan down the road.